FHA Loans: A Guide For First-Time Homebuyers

What is an FHA Loan?

A Federal Housing Administration (FHA) loan is a mortgage loan designed to help less financially established people purchase a home. This type of mortgage is commonly used with first-time homebuyers who may not have had time to save a ton for a down payment or pay down all their debts yet. When you buy a home, you choose between two basic types of mortgages: conventional and government-backed.

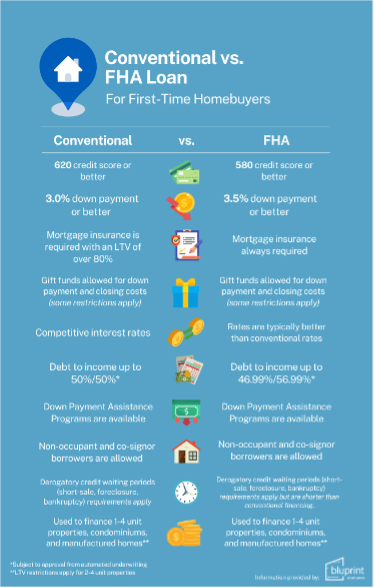

A conventional mortgage is not backed by a government agency and is a little harder to get than a government-backed loan. A conventional mortgage may require as little as a 3% down payment and requires a 620 credit score or better and a 45% debt-to-income ratio.

A government-backed mortgage is a type of mortgage loan that’s insured by an agency of the federal government. If you default on your mortgage payments, then the FHA offers your lender insurance for their losses. The FHA offers several types of home loans, including loans for home improvements, and are usually easier to qualify for than a conventional loan.

It’s important to note that with an FHA loan, the FHA doesn’t actually lend you money for a mortgage. Instead, you get a loan from an FHA-approved lender, like a bank or another financial institution. The good news, however, is that the FHA guarantees the loan. To secure the guarantee of the FHA, borrowers that qualify for an FHA loan are also required to purchase mortgage insurance, and premium payments are made to FHA. As a result, your lender bears less risk because the FHA will pay a claim to the lender in the case of a default on the loan.

Different Types of FHA Loans

FHA offers several different programs that are designed to help people in various financial situations and desired transaction types. Some of the most commonly used programs include:

203(b) Loans: These are what most people think of when talking about FHA loans. They’re used to either purchase or refinance a home and require down payments as low as 3.5%.

203(k) Loans: Also called 203(k) Rehabilitation mortgages, these loans are designed for both buyers and existing homeowners, allowing them to finance eligible home repairs and improvements.

245(a) Loans*: Also called Graduated Mortgage Payment Program, these loans are designed for people at a low-to-moderate income level. You start with low monthly payments, and your payments increase as your income increases.

BluPrint does not offer these loan types. This is for information only.

Construction To Permanent*: This is particularly designed for people building a home.

BluPrint does not offer these loan types. This is for information only.

EEM Loans: This loan helps homeowners finance home improvements that reduce energy use on the property. They can be used to purchase a home and improve it all at once or to improve a home you already own.

Title 1 Property Investment Loan*: This home improvement loan helps you make essential upgrades to your home.

BluPrint does not offer these loan types. This is for information only.

HECMs: Home Equity Conversion Mortgages (HECM) loans are more commonly known as reverse mortgages. They’re designed for homeowners over the age of 62, allowing them to turn their home’s equity into tax-free cash.

For existing homeowners who already have FHA loans, there is also the streamline refinance. This is a sped-up refinance option that requires little financial documentation. You also might not need a credit check for this type of loan. To learn more about refinancing, click here.

Who Qualifies For an FHA Loan

To receive an FHA loan, the borrower must meet all of the following criteria:

Credit Score and Down Payment: If your credit score is at least 580, then you’ll need 3.5% for a down payment.

Debt-To-Income (DTI) Ratio: Your DTI ratio is the monthly amount you pay toward debts divided by your gross monthly income. For an FHA loan, your DTI ratio should be 43% or lower. However, FHA will currently insure loans for higher DTI’s for borrowers that demonstrate other financial strengths in their credit profile.

Property Type: You can use an FHA loan to buy a single-family home, or a multi-family home for up to four families. You can also buy a condo or manufactured home.

Borrowing Limit: The FHA restricts how much you can borrow. The limit depends on where you live and what type of property you buy. For example, the limit for a two-family home in Los Angeles will be different than for a four-family home in Orlando. Enter your state and county information to see your borrowing limits on the US Department of Housing and Urban Development website.

Property Standards: You can use an FHA loan to buy a home with normal wear and tear but not one with major structural or safety issues. For example, your roof must be in good condition, and the home can’t be near a hazardous waste location.

How To Get An FHA Loan

Not all mortgage lenders offer FHA loans, so the first step is to find one who does. Look no further, the great news is that we do. Here’s what you’ll need:

Get pre-approved: The mortgage pre-approval process varies but typically involves filling out some basic information.

Fill out our loan application: Submit it for a credit check.

Provide financial documentation: This can include your recent pay stubs, W-2s, tax returns, bank account statements, and more. Your loan officer will tell you the exact documents you’ll need to provide, so we’ll be there with you every step of the way.

Wait for your property appraisal: A property appraisal ensures your home is worth the amount of money you’re looking to borrow for it. During this time, the appraiser will check to ensure the property meets FHA construction and habitability guidelines.

Keep in touch with your loan officer: At BluPrint, we’re all about proper communication. As your mortgage is processed and underwritten, your loan officer might need additional paperwork along the way. We’ll keep in close contact with you every step of the way to ensure you’re in the loop at all times.

Attend your closing appointment: The final step! This includes paying your closing costs and down payment as well as getting your keys. To be extra prepared for your loan, click here.

Final Thoughts

If you’re debating the advantages of an FHA loan compared to a conventional loan, know that a conventional loan is not government-backed. Conventional loans are offered through Fannie Mae or Freddie Mac, which are government-sponsored enterprises that provide mortgage funds to lenders. They have more requirements, so keep in mind that you’ll need a higher credit score and a lower DTI to qualify. Another thing to keep in mind is FHA loans are typically better suited for first-time homebuyers, buyers with a credit score below 620, or buyers looking for a low down payment option, while conventional loans are a good fit for borrowers with a credit score above 620 or real estate investors.

Regardless of whether you choose a conventional or FHA loan, know that there are a few other costs to keep in mind. You’ll need to pay closing costs, which are the fees associated with processing and securing your loan. These closing costs are required but vary depending on the price of the house and the type of mortgage. It’s recommended that you budget 3% – 6% of your home’s value. BluPrint Home Loans partners with several different down payment assistance programs that can help with this piece, but you will need to discuss those options with one of our expert Loan Originators.

You should also budget 1% – 3% of your purchase price for maintenance. The exact percentage is going to depend on the age of the house. If your house is newer, the odds are fewer things are likely to break right away. However, if the house is on the older end, you may need to set aside more. Last but not least, if you live in an area with homeowners association fees, you’ll end up paying for those on a monthly or yearly basis.

If you’re in the market for a loan with lenient credit, lower down payment, and low-to-moderate income requirements, an FHA loan might be right for you. Check out your options here.

BluPrint Home Loans is a Division of NFM, Inc. dba NFM Lending, NFM NMLS #2893. NFM is an Equal Housing Lender. Some products and services may not be available in all states. Licensing and disclosure information can be found at https://nfmlending.com/licensing/

Corporate HQ

Follow Us

- Arizona Mortgage Lender

- Alabama Mortgage Lender

- California Mortgage Lender

- Colorado Mortgage Lender

- Connecticut Mortgage Lender

- Delaware Mortage Lender

- District of Columbia Mortage Lender

- Florida Mortage Lender

- Georgia Mortage Lender

- Idaho Mortage Lender

- Illinois Mortage Lender

- Indiana Mortage Lender

- Kansas Mortage Lender

- Kentucky Mortage Lender

- Louisiana Mortage Lender

- Maine Mortage Lender

- Maryland Mortage Lender

- Massachusetts Mortage Lender

- Michigan Mortage Lender

- Minnesota Mortage Lender

- Mississippi Mortage Lender

- Montana Mortage Lender

- Nevada Mortage Lender

- New Hampshire Mortage Lender

Equal housing lender. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Refinancing an existing loan may result in the total finance charges being higher over the life of the loan. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Qualifying credit score needed for conventional loans. LTV’s can be as high as 96.5% for FHA loans. FHA minimum FICO score required. Fixed rate loans only. W2 transcript option not permitted. Veterans Affairs loans require a funding fee, which is based on various loan characteristics. For USDA loans, 100% financing, no down payment is required. The loan amount may not exceed 100% of the appraised value, plus the guarantee fee may be included. Loan is limited to the appraised value without the pool, if applicable. The pre-approval may be issued before or after a home is found. A pre-approval is an initial verification that the buyer has the income and assets to afford a home up to a certain amount. This means we have pulled credit, collected documents, verified assets, submitted the file to processing and underwriting, ordered verification of rent and employment, completed an analysis of credit, debt ratio and assets, and issued the pre-approval. The pre-approval is contingent upon no changes to financials and property approval/appraisal. For Arizona originators: AZ# BK-0934973. In Alaska, business will only be conducted under NFM Lending and not any of our affiliate sites.